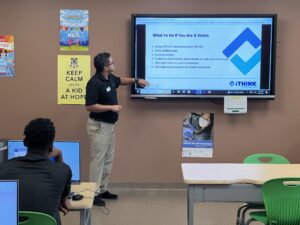

On Friday, June 23, we had a guest speaker who talked about budgeting, spending, and credit fraud. We learned that we should be careful when we receive an email with a link from someone we don’t know, and to not click it because it could cause a virus, or we could get hacked. We also learned to be aware of spam calls, because technology today is getting smarter. What I mean by that is, now hackers can call under someone you know and say something like, “I’m in jail and need a $50,000 bail” or “Your mom is ill, and her medical bill is $25,000.” The best way to avoid being scammed is to call the person to confirm the information claim. Also, if you get a call about winning something or getting a job and you would get paid a lot of money, then hang up. It is most likely a scam. We also learned to be careful who is around when you are at an ATM.

Additionally, we learned how to budget money. A budget is a spending plan based on your expenses and income. We learned that every time we spend money, we are choosing one thing over another. We learned that when you budget your money, you can save your money in case of an emergency or to save up for a goal, such as starting your own business. We also learned the 50-30-20 rule. The 50-30-20 rule is when 50% of your income goes into what you need (bills, utilities, insurance, etc.), 30% goes into your wants (coffee, new bags, new shoes, etc.), and 20% goes into your savings.